Utility Bills

Telephone, gas and electricity bills usually include a standing charge plus a cost for each unit used. VAT is added to the whole bill.

VAT is payable on the whole bill.

Loans

Secured Loans – Your house is at risk if you default.

Unsecured Loans – Goods are yours; house is safe.

Hire Purchase – Goods become yours after final payment.

Mortgages – Secured loans for houses, ships, etc.

Joe Bloggs wishes to borrow £10,000. Which option is cheapest?

EasyLoan costs £17,343 over 15 years.

Loans R Us costs £11,122.56 over 3 years (unprotected).

Fred’s Finance:

Cheapest: Loans R Us (3 years, unprotected).

Hire Purchase (HP)

HP requires a deposit followed by fixed monthly payments. Goods become yours only after the final payment.

A TV costs £600 cash.

HP: 10% deposit + 36 × £15.75.

How much cheaper is cash?

Cash is £27 cheaper.

Car Finance

Options when buying a car:

- Cash: Buy outright.

- Car Loan: Spread cost over time.

- HP: Own after final payment.

- PCP: Pay for depreciation; optional final payment.

- PCH / Leasing: Long‑term rental; never own.

Hire Purchase (HP)

Key Features

- Contracts up to 5 years.

- Flexible deposit.

- You own the car at the end.

- No mileage limits.

Risks

- You do not own the car until the final payment.

- Missed payments may lead to repossession.

Personal Contract Purchase (PCP)

Key Features

- Lower monthly payments.

- Options at end: return, upgrade, or buy.

Risks

- Mileage limits apply.

- Excess wear charges possible.

- You only own the car if you pay the final amount.

Leasing / PCH

Key Features

- 24–48 month contracts.

- Flexible initial rental.

Risks

- You never own the car.

- Charges for excess mileage or damage.

Insurance

Insurance premiums depend on the probability of an event happening. Higher risk → higher premium.

Bodgit Insurance charges £3.50 per £1000 of house value.

Cost to insure a £189,000 house?

Bank Interest

Interest is a percentage of capital charged on loans or paid on savings.

Simple Interest

Simple interest is calculated only on the original capital.

Calculate simple interest on £500 for 3 years at 6%.

Compound Interest

Compound interest uses interest earned to increase capital.

Calculate compound interest on £500 for 3 years at 6%.

Using the CRy mnemonic:

For monthly rates, convert years → months.

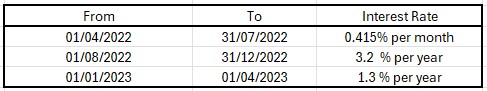

More than one interest period

CRy can be chained:

Capital × rate₁term₁ × rate₂term₂ × …

£5,000 placed in savings on 1 April 2022.

Balance = £5167.33

Effective Interest

Effective interest accounts for compounding.

EAR (Effective Annual Rate) is used for loans.

AER (Annual Equivalent Rate) is used for savings.

A loan has a nominal rate of 5%. Find EAR if compounded:

- Semi‑annually

- Monthly

- Daily

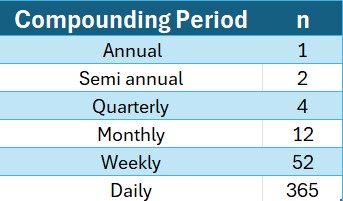

Changing between interest periods

Source: LibreTexts Mathematics

To convert annual effective → monthly effective:

Do NOT divide by 12!

The monthly effective interest rate is 0.31% (1 d.p.).

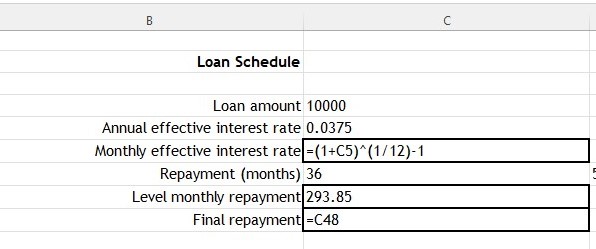

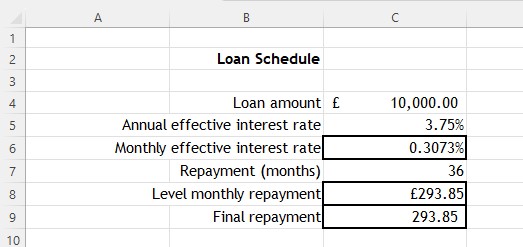

Use in Loan Schedules

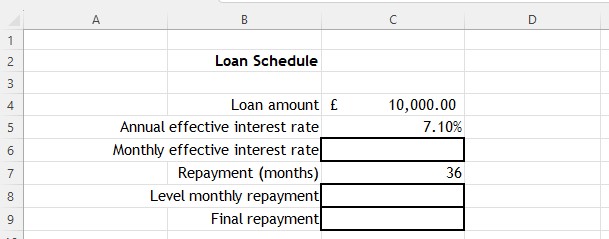

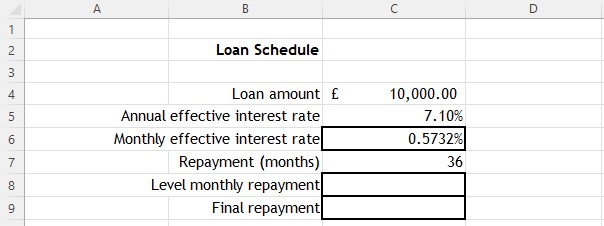

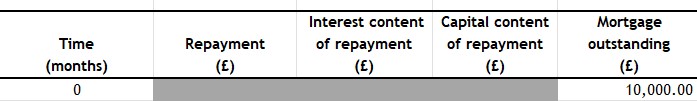

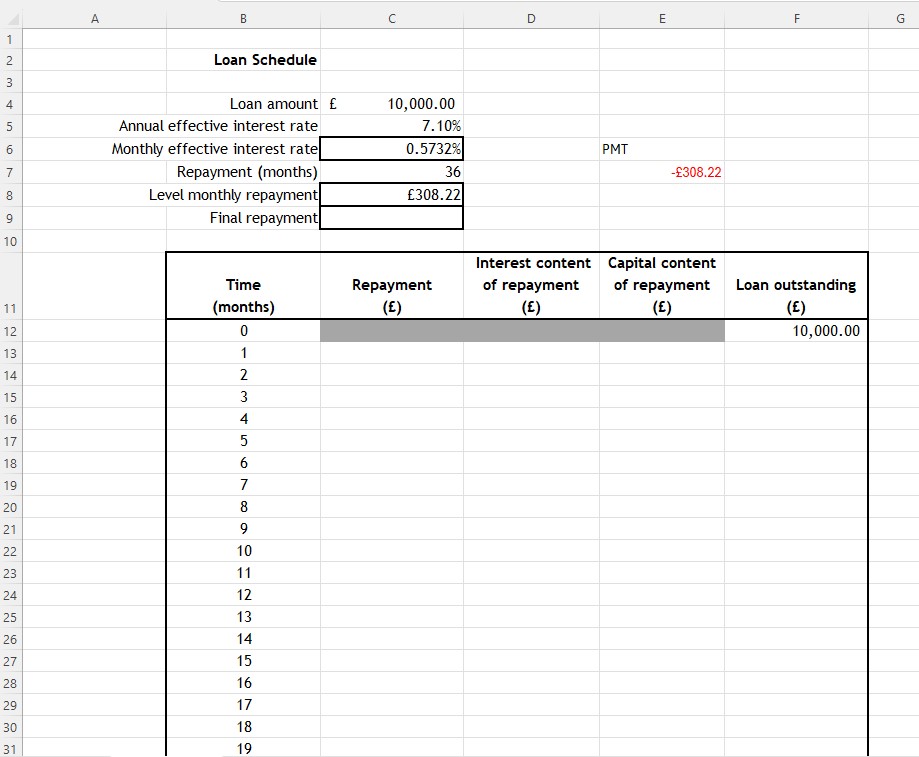

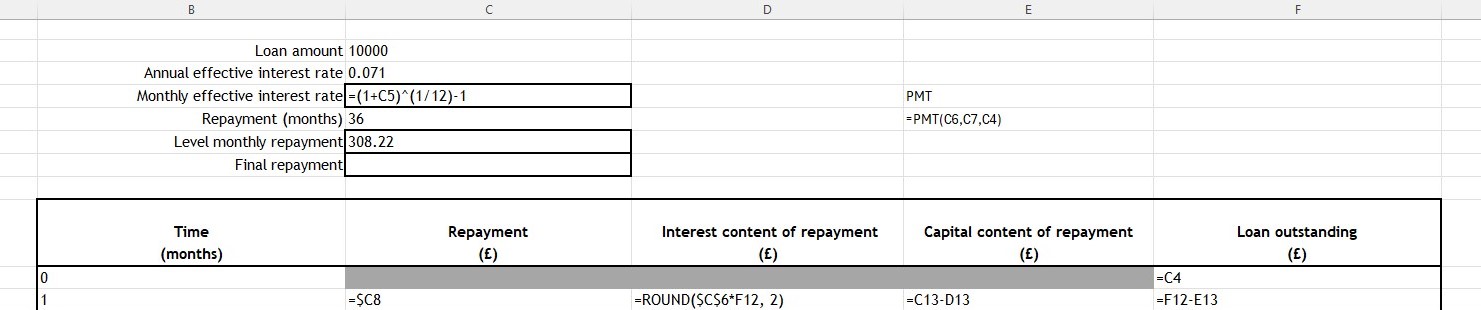

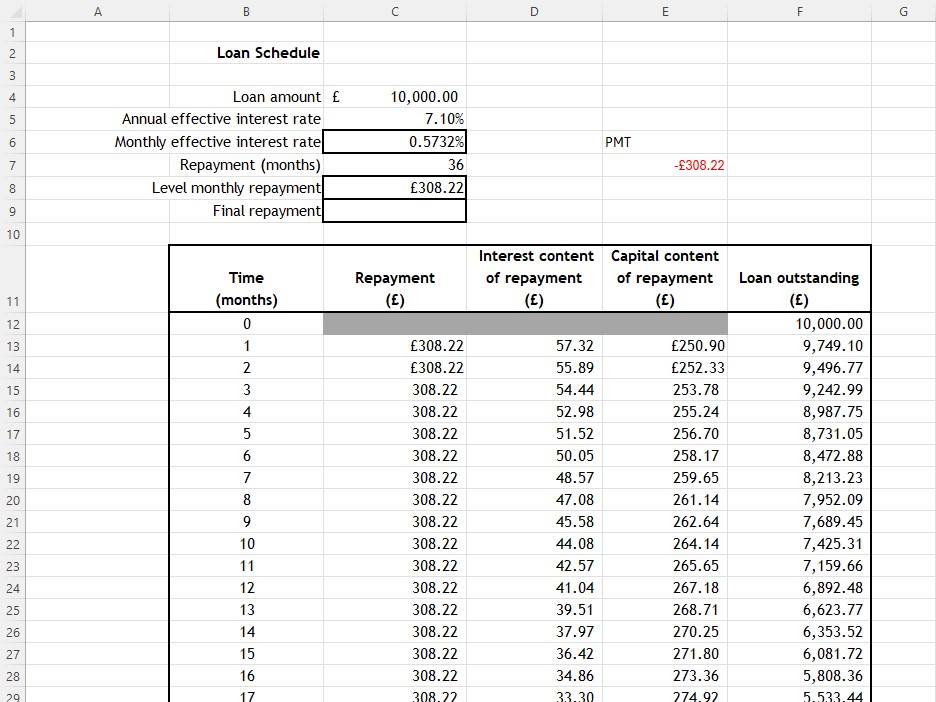

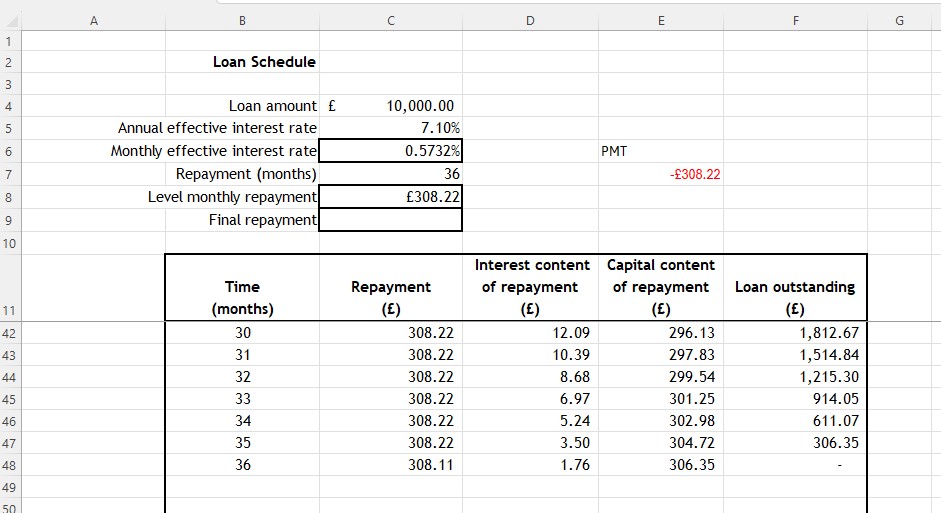

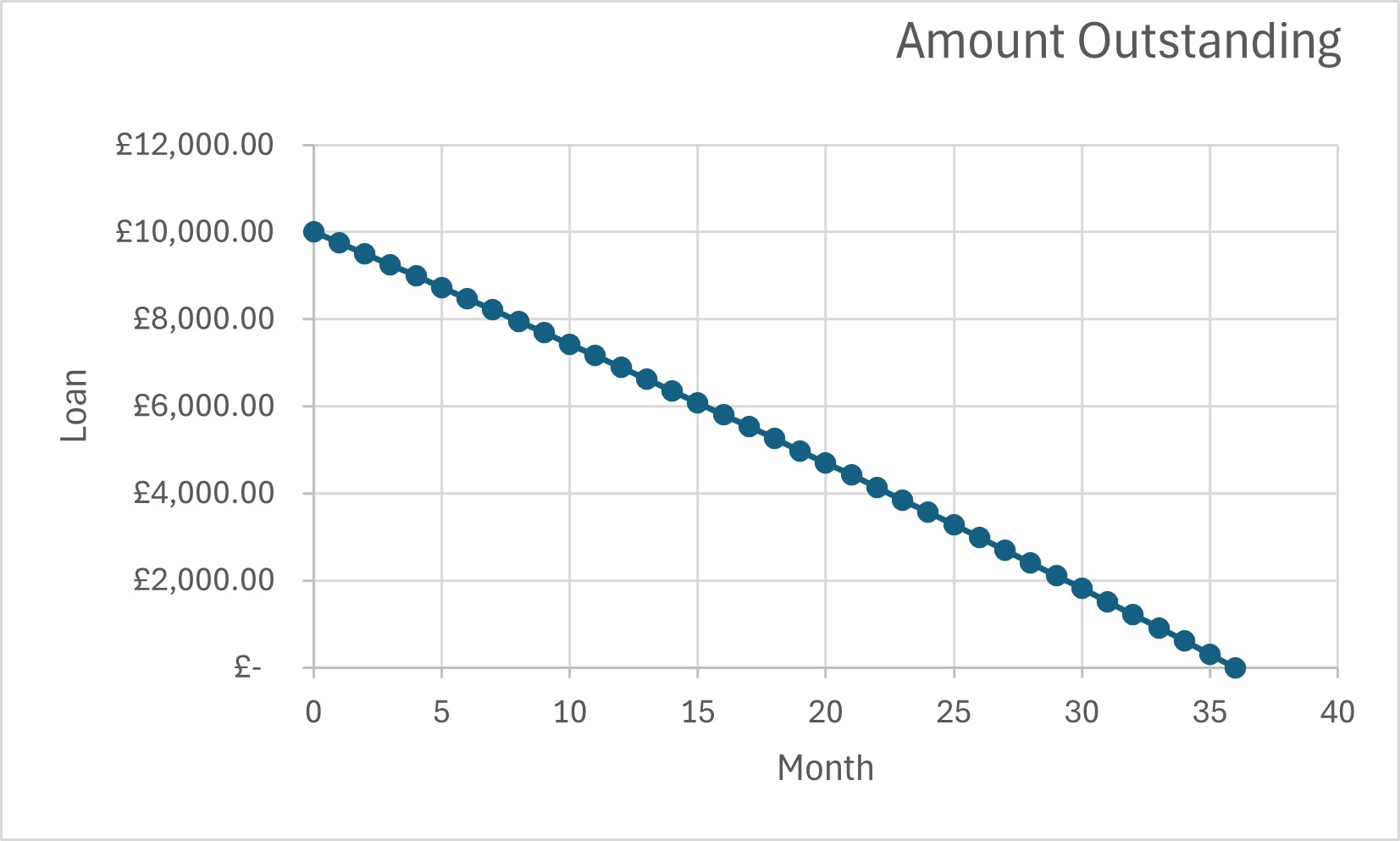

A loan of £10,000 is borrowed over 3 years. The annual effective interest rate is 7.1%.

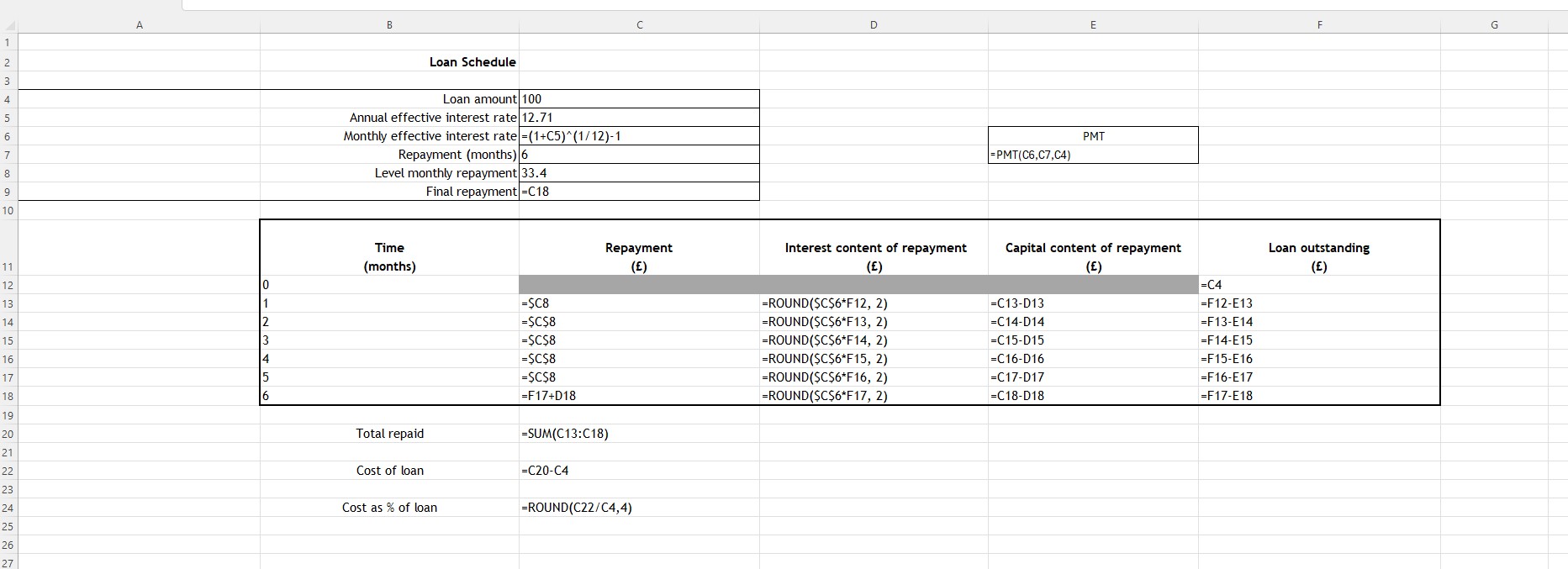

Enter the formula =(1+C5)^(1/12)-1 into cell C6 to calculate the monthly effective interest rate.

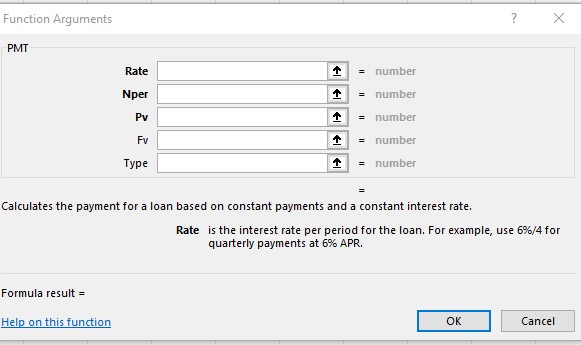

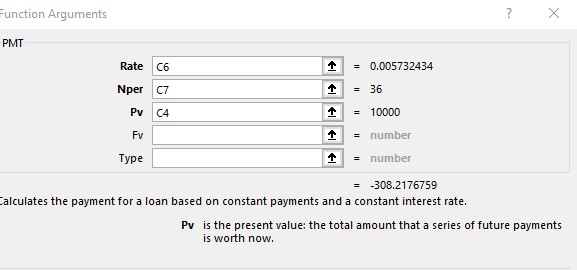

The Excel function PMT calculates payments based on a constant interest rate and number of periods.

Here:

- Rate = effective monthly rate (C6)

- NPER = number of payments (C7)

- PV = loan value (C4)

This gives a fixed monthly payment of £308.22.

Set up a loan schedule with these headings:

Enter =$C$4 into F12

(type =C4 then press F4).

Extend the table down to 36 months.

Repayment is C8, so enter =$C$8 in C13.

Interest content: =ROUND($C$6*F12,2)

Capital repaid: =C13-D13

New balance: =F12-E13

Copy down to the final row.

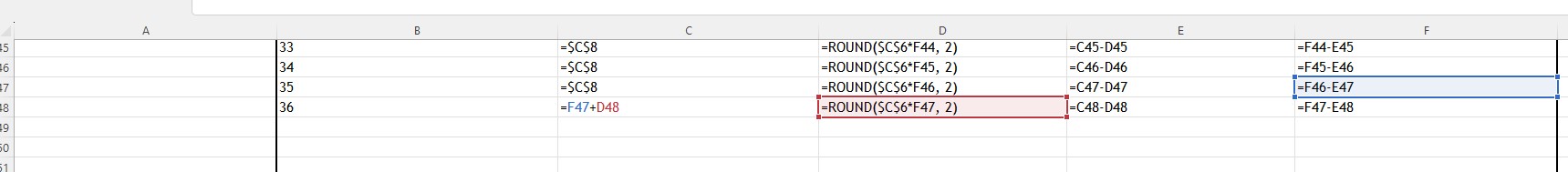

The final payment differs. Enter =F47 + D48 into C48.

Summary:

This can be represented by the recurrence relation:

\[

U_{n+1} = 1.0057U_n - 308.22

\]

From the graph, after 15 months the outstanding loan is approximately £6,000.

Comparing Loans

The effective monthly rate can be used to compare loan offers quickly.

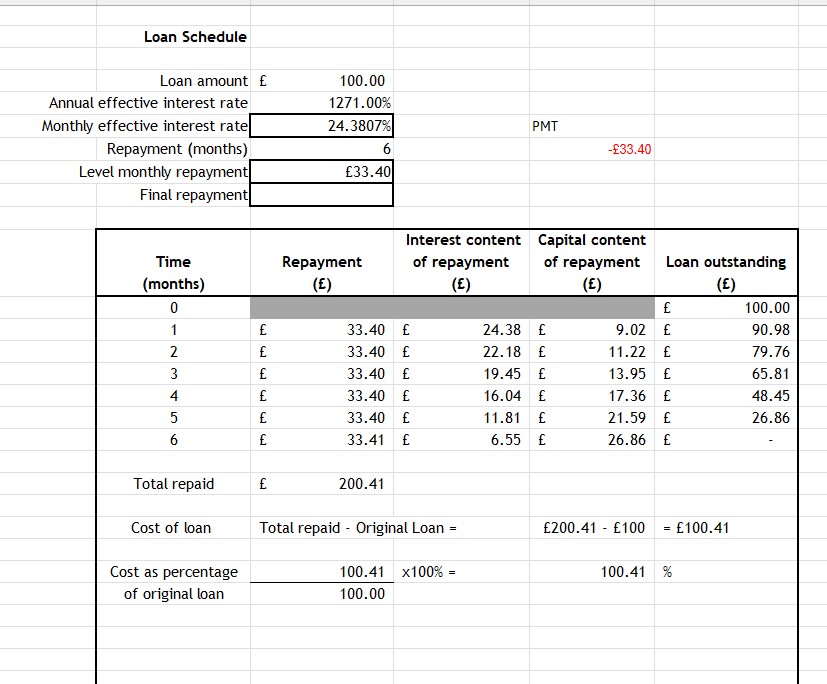

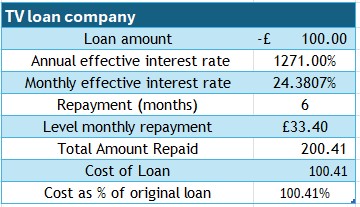

A TV advert offers short‑term loans with a typical annual interest rate of 1271%.

- Create a loan schedule for £100 over 6 months.

- Calculate the cost of the loan.

- Express the cost as a percentage of the original loan.

- Comment on your findings.

1. Total repaid = £200.41

2. Cost = £200.41 − £100 = £100.41

3. Percentage = (£100.41 ÷ £100) × 100% = 100.41%

4. The cost of borrowing exceeds the original loan!

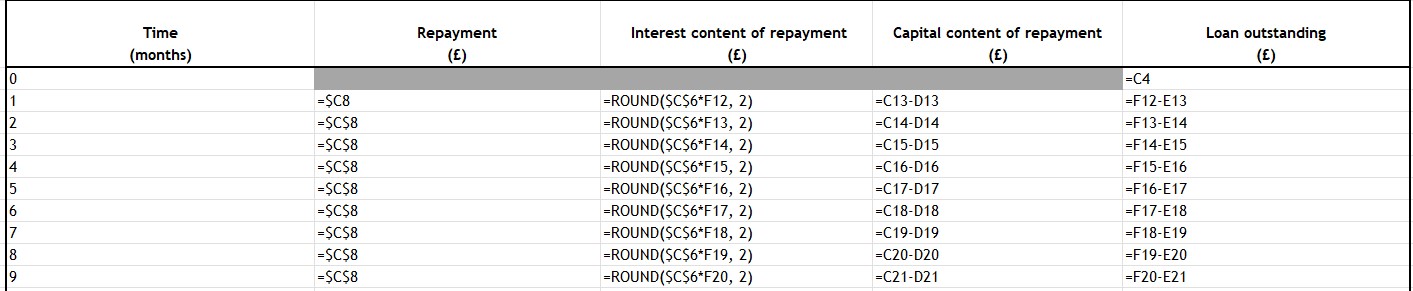

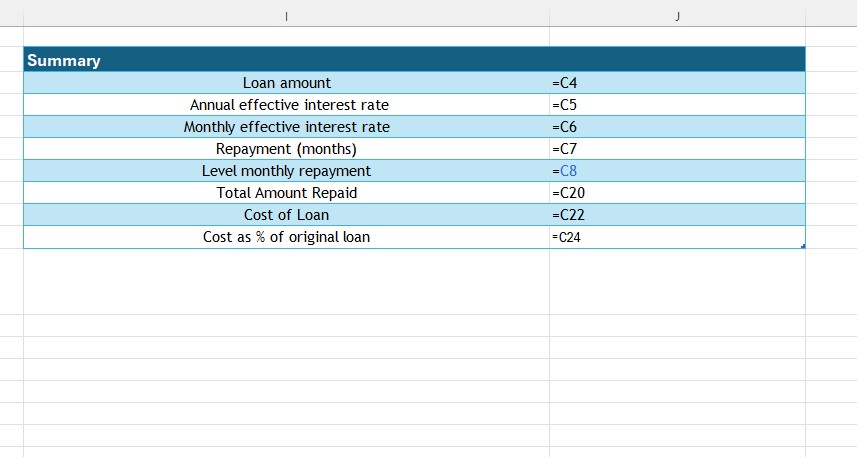

Excel formula view:

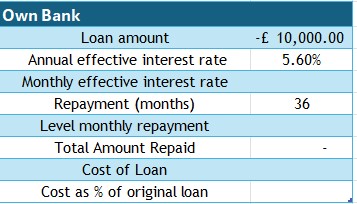

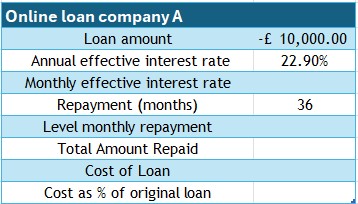

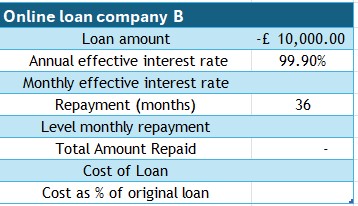

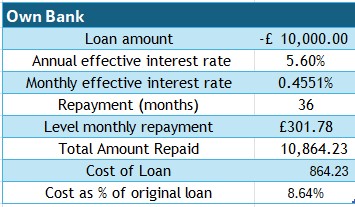

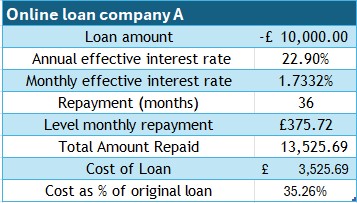

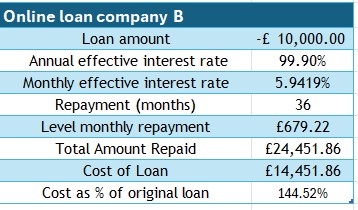

£10,000 loan over 3 years. Compare providers:

- Own Bank: AER 5.6%

- Internet Bank A: AER 22.9%

- Internet Bank B: AER 99.9%

Loan information boxes:

Comment on findings:

Clearly, the loan from Own Bank is cheapest.

Internet Bank B’s monthly effective rate is higher than Own Bank’s

annual rate!

Nominal interest rate from effective rate

If given EAR/AER, the nominal rate can be found by changing the subject of the formula .

So:

where i = nominal rate, r = effective annual rate, n = compounding periods.

EAR = 9%, compounded monthly. Find nominal rate.

Alternatively:

Nominal rate = 8.6% (1 d.p.)

Annual rate = 61.94%. Find effective monthly rate.

Effective monthly rate = 4.1% (1 d.p.)

Alternatively:

Substituting:

APR (Annual Percentage Rate)

APR is the interest rate paid each year on a loan. It includes fees and charges but does not include compounding.

Foreign Exchange

Converting currency is an application of ratio .

Converting into another currency

Example

Fred converts £150 into US dollars.

Rate: £1 = $1.67.

How many dollars does he get?

£150 × 1.67 = $250.50

Using the rule of 3:

Converting back

Fred converts $75 back into pounds.

Rate: £1 = $1.67.

How many pounds?

$75 ÷ 1.67 = £44.91

Using rule of 3:

Joe converts $150 into Euros and receives €108.09.

No commission. What was the exchange rate?

or