Payslips

Payslips come in a variety of designs. They usually show totals, deductions, and personal information, in addition to the actual pay.

Basic Pay = Pay earned during the period without overtime.

Gross Pay = Total income earned during the pay period.

Total Deductions = All money taken off.

Net Pay = Gross pay − Total deductions.

This is what you receive “in hand” or “bottom line”.

Tax Code: This shows how much you may earn before paying tax.

Here, Joe Bloggs can earn £3960 before tax is deducted.

What is Joe Bloggs’ salary?

Joe Bloggs’ annual salary is £25,596.

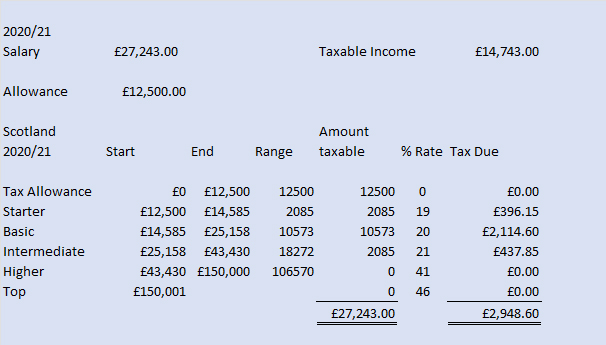

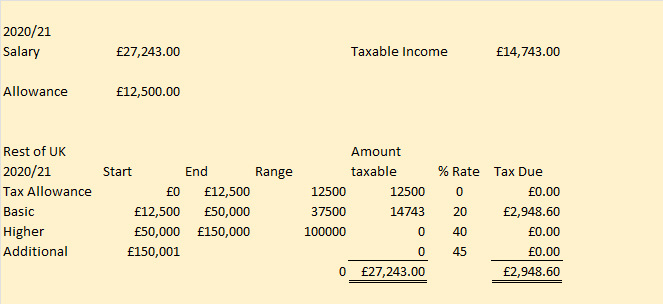

Income Tax: Scotland vs Rest of UK

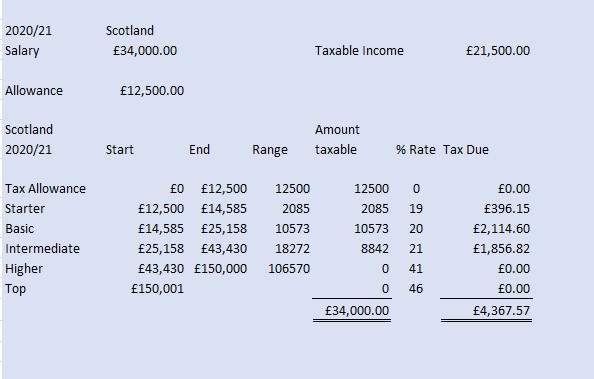

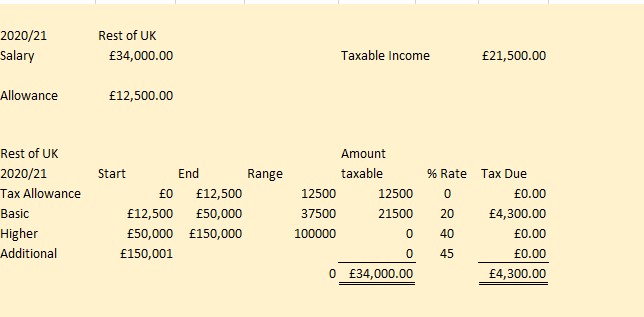

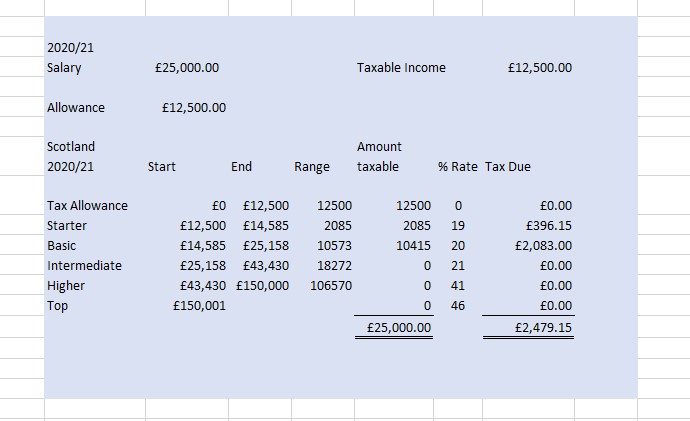

The following examples compare income tax calculations for Scotland and the rest of the UK during tax year 2020/21.

Source: Tax Bands - Scottish Government

John Doe has a salary of £34,000 and a personal allowance of £12,500. What is the difference in tax paid between Scotland and the rest of the UK?

Scotland

Total Scottish income tax due: £4,367.57

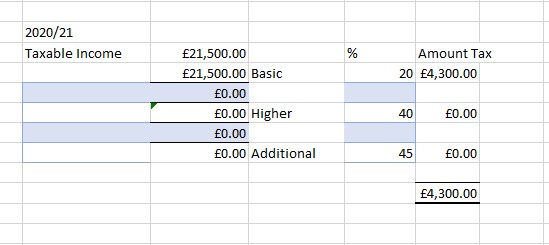

Rest of UK

In the rest of the UK, John pays a flat rate of 20% on all taxable income because £21,500 is below the higher-rate threshold.

Total UK income tax due: £4,300.00

John pays £67.57 more tax in Scotland than in the rest of the UK.

Alternative view

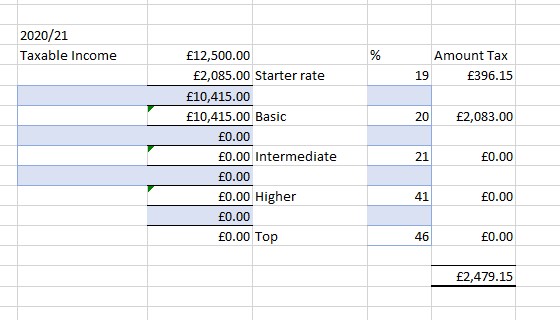

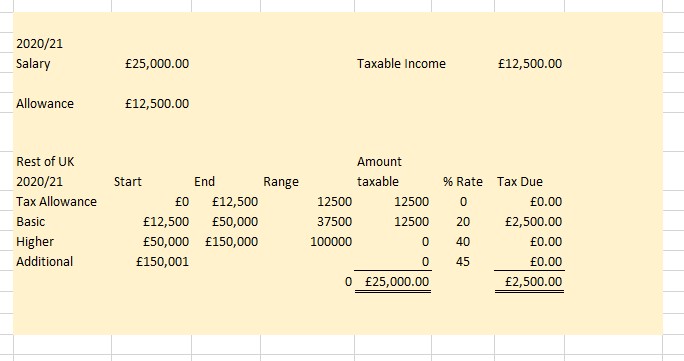

A person earning £25,000 in tax year 2020/21 with a personal allowance of £12,500 would pay £20.85 less in Scotland than in the rest of the UK.

Scotland

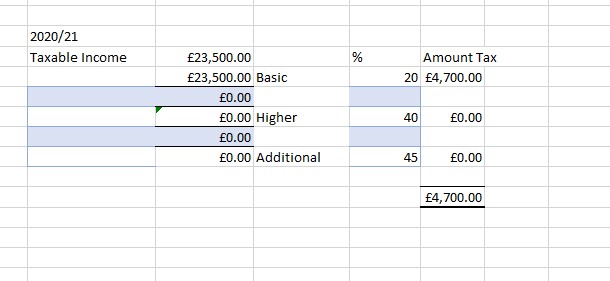

Alternative calculation

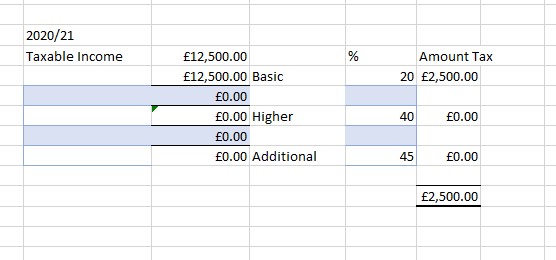

Rest of UK

Alternative calculation

£2,500 − £2,479.15 = £20.85 less tax in Scotland.

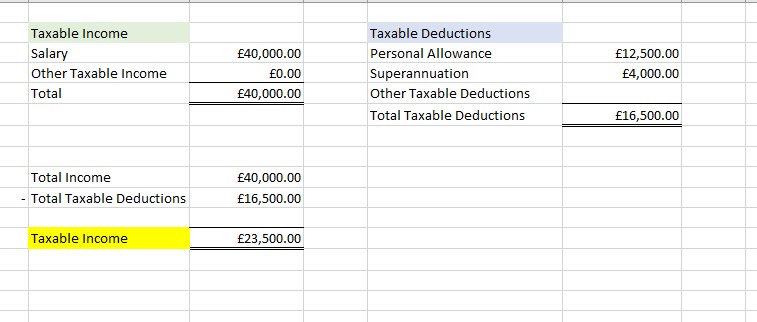

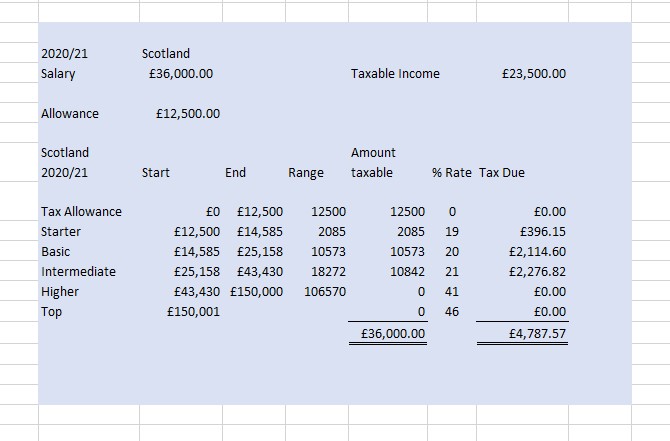

A person earns £40,000 in tax year 2020/21 and pays 10% into a pension (superannuation).

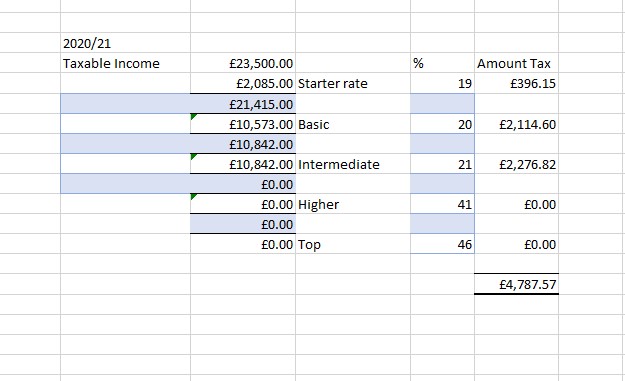

Tax due in Scotland

Or, since pension is tax‑deductible, taxable salary becomes £36,000:

Rest of UK

£4,787.57 − £4,700 = £87.57 more tax in Scotland.

In tax year 2020/21, a salary of £27,243 resulted in equal income tax in Scotland and the rest of the UK.

A salary greater than £27,243 results in more income tax being due in Scotland.

A salary less than £27,243 results in less income tax being due in Scotland.

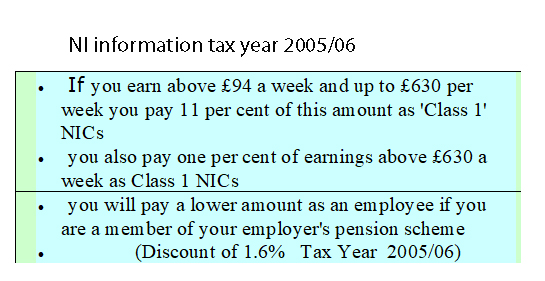

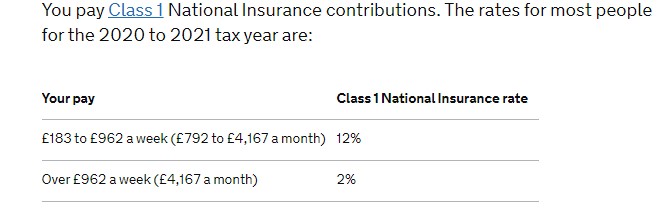

National Insurance

National Insurance Contributions (NICs) are paid in addition to income tax. The earnings threshold is the amount you can earn before NICs are deducted.

For the tax year 2005/06, the earnings threshold was:

- £94 per week

- £408 per month

Using the payslip above:

How much Class 1 National Insurance was Joe Bloggs due to pay per month in 2005/06?

Rates for 2020/21

Using these rates, calculate the Class 1 National Insurance due for John Doe from the earlier example.